Form Fulfillment Only

United ACA Solutions offers a streamlined and secure Electronic Transmission service designed for employers needing to submit 1094-C and 1095-C forms to the IRS. As of 2023, the IRS stipulates that any entity filing 10 or more 1095-C forms must do so electronically. This process requires obtaining a Transmitter Control Code (TCC) and developing transmission software recognized by the IRS - a task that can be both technically challenging and financially burdensome.

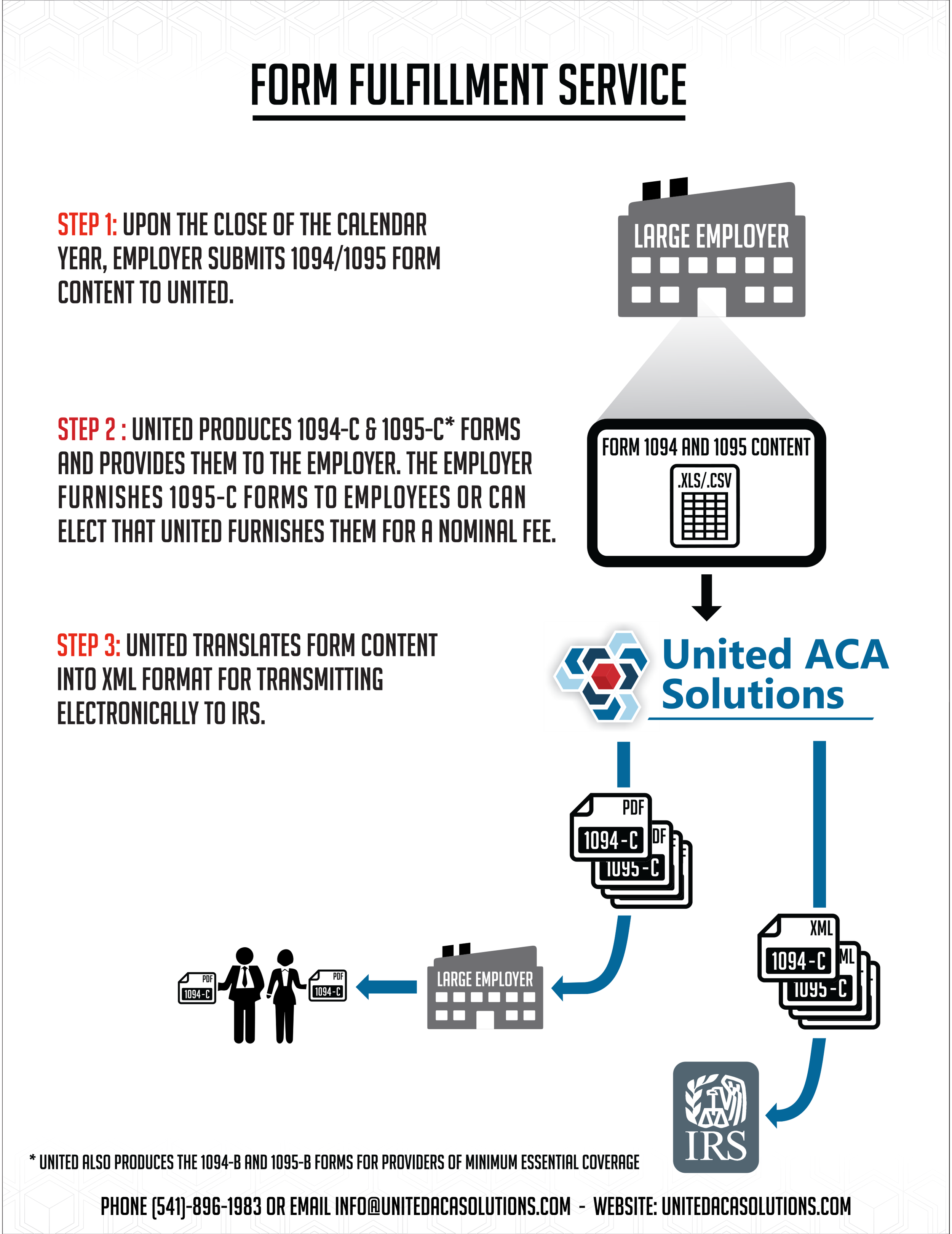

To alleviate this pressure, our service employs our already established software and TCC to submit the required data on behalf of the employers. The only thing we need from employers is the content for the 1094-C and 1095-C forms in a machine-readable format. From there, we handle the rest, making sure your data is accurately and securely transmitted to the IRS.

This service presents a cost-effective solution that simplifies compliance with IRS requirements, saving valuable time and resources for employers. So, rather than worrying about meeting technological requirements or risking potential non-compliance penalties, you can trust United ACA Solutions to take care of the transmission process on your behalf, ensuring a secure, compliant, and hassle-free experience.

How It Works:

Your Data: You provide us with all the necessary information and codes that belong on the forms.

Expertise at Your Fingertips: While you handle the data and codes, our team of ACA experts is ready to assist if needed. We are well-versed in the intricacies of IRC 4980H, 6056, and 6055 regulations, and we're here to support you.

Effortless PDF Form Generation: United ACA Solutions will generate the IRS 1094-C/B and 1095-C/B forms, ensuring accuracy and compliance every step of the way.

Electronic Filing: Once the forms are complete, we handle the electronic transmission to the IRS. Rest assured that your forms will be filed promptly and in accordance with IRS regulations.

Not what you’re looking for?

See a list of additional ACA-related services we offer, including other reporting services, IRS Letter response, ALE Determinations, and Risk Assessments